Cybersecurity in Finance - Denver & Colorado Insights

Denver's financial sector, nestled in the Rocky Mountains, faces a serious but often invisible enemy: cybercrime. The numbers are eye-opening - experts predict cybercrime will cost the world $10.5 trillion annually by 2025. As Colorado's financial center grows, protecting our banks and financial institutions from cyber threats has become more important than ever.

That’s why you need to partner with Tekkis Cyber Security. Our expert solutions are designed to safeguard your financial operations against the expanding threat of cybercrime. Don’t wait until it’s too late—contact us today to strengthen your cybersecurity defenses!

Also Read:

Why is Cybersecurity in Finance Important?

Let's face it - financial institutions are like honey to cyber criminals. Banks, credit unions, and investment firms handle massive amounts of sensitive information, from personal details to money transfers. It's no wonder they're prime targets for cyber attacks.

As financial services become more digital, we're seeing both new opportunities and new risks. The cybersecurity industry is booming - currently worth $172.24 billion and expected to hit $562.72 billion by 2032, growing at 13.8% yearly. This shows just how seriously organizations are taking these threats.

Denver and Colorado's financial institutions face special challenges because they're such important economic players in the region. With so many financial services concentrated in one area, it's like a buffet for cybercriminals. That's why strong cybersecurity isn't just nice to have - it's essential.

The cost of poor cybersecurity can be huge. Beyond just losing money, banks can damage their reputation, lose customer trust, face hefty fines, and even legal problems. In today's connected world, one security breach can create a ripple effect, hurting multiple institutions and their customers.

Common Cyber Threats Affecting Financial Institutions

The financial world faces some scary numbers when it comes to cyber threats - each breach costs about $5.86 million on average. That's why understanding these threats is crucial for staying protected.

Research shows that 75% of financial sector breaches involve hacking and malware. These attacks often start with clever phishing emails targeting everyone, from entry-level employees to top executives. Criminals are getting better at making fake emails look real, trying to steal login details, or planting harmful software.

Ransomware has become particularly nasty. These attacks can lock up important financial data and systems, bringing everything to a halt. Criminals usually want large cryptocurrency payments to unlock the systems, leaving institutions with a tough choice - pay up or face lengthy downtime.

Inside threats are another worry, causing 6% of breaches. Whether it's intentional or accidental, employees with access to sensitive systems can compromise security. Another 18% of breaches happen through accidental disclosure, showing why good data handling practices and employee training are so important.

Physical security breaches make up just 2% of incidents, but they're still important. These might include break-ins to server rooms, stolen devices with sensitive data, or tampered ATMs. Since physical and digital security are connected, banks need to protect both.

Unique Cybersecurity Challenges in Denver and Colorado

Denver's growing financial sector faces unique security challenges as the city becomes a major tech hub. The local cybersecurity industry is booming, and the threats keep evolving. While this tech growth is great for the economy, it makes keeping financial institutions safe more complex.

Denver's top cybersecurity firms focus mainly on three areas: cloud security, hunting down threats, responding to incidents, and managing who can access what (IAM). These have become crucial as banks move more services to the cloud and face smarter cyber threats. The challenge isn't just implementing these solutions - it's finding qualified people to run them.

Strategies for Enhancing Cybersecurity in Financial Services

Implementing Robust Security Protocols

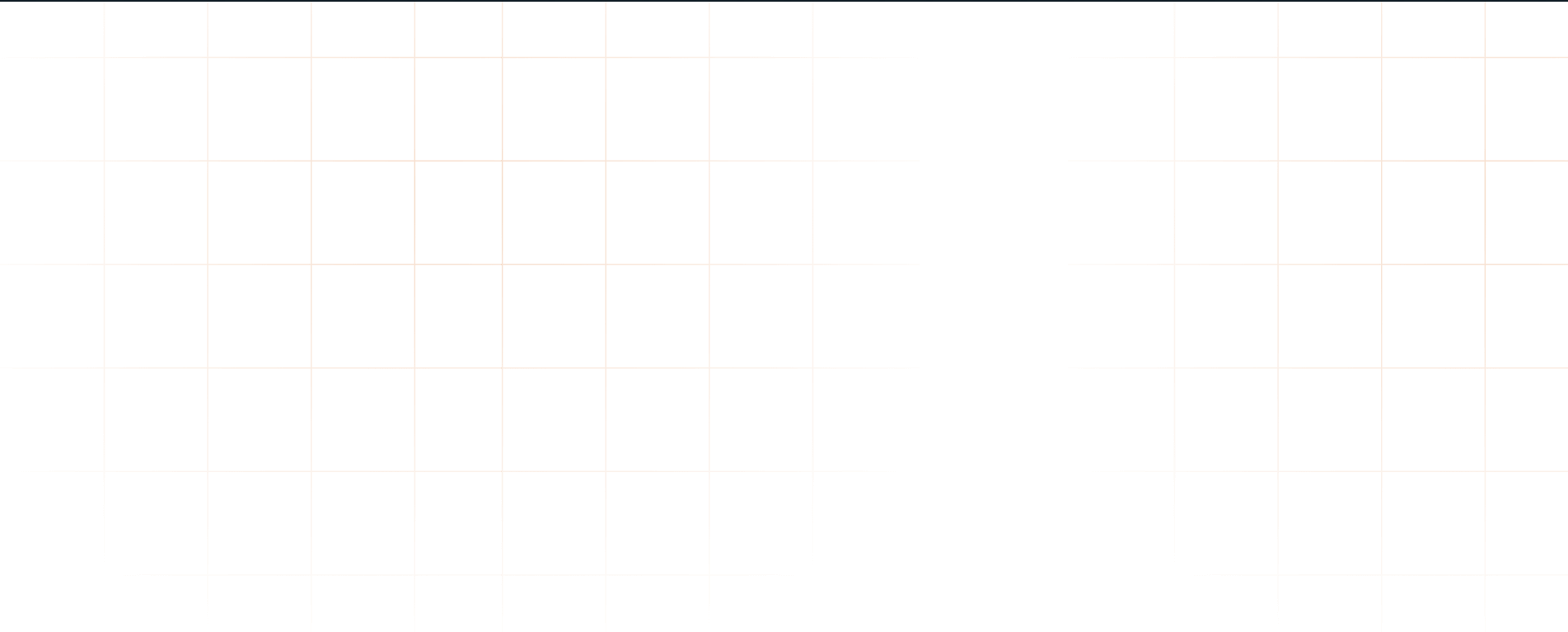

Good security is like an onion - it needs multiple layers. The basics start with strong access controls using multi-factor authentication, making sure only the right people can get into sensitive systems. Banks also need to encrypt all their data, whether it's being moved around or sitting in storage.

Regular security checks aren't optional anymore. You need to run full security audits at least every three months, with constant vulnerability scanning. The Zero Trust approach has proven really effective - it means everyone needs to prove who they are to access the network, no matter their position or where they're working from.

Importance of Employee Training and Awareness Programs

People can be your strongest defense or your biggest weakness in cybersecurity. A good training program isn't just about teaching technical stuff - it's about getting everyone to think security-first. Monthly phishing tests and security awareness training help keep staff on their toes.

Different jobs need different kinds of training. Customer service staff need to know about social engineering tricks, while IT teams need deeper technical security knowledge. Hands-on workshops and real-world scenarios work better than just lecturing people about security.

Utilizing Advanced Technologies and Tools

AI and machine learning have changed the game in spotting threats. These tools can analyze huge amounts of data in real time, catching potential problems before they become real breaches. They can spot weird patterns in how people use systems, flagging possible insider threats or hacked accounts right away.

Blockchain has become a powerful way to secure financial transactions and keep records that can't be tampered with. Its decentralized setup makes it really hard to hack or fake. Also, automated security tools (SOAR platforms) help manage complex security operations and respond to threats faster.

Cloud-based security offers flexibility and room to grow while keeping things secure. But it's crucial to carefully check cloud providers and make sure they meet or beat industry security standards. You should regularly test your backup and recovery plans to make sure you can keep running if something goes wrong.

Cybersecurity Regulations and Compliance in Colorado

Key Regulatory Bodies and Frameworks

Colorado's cybersecurity rules involve several authorities, with local cybersecurity companies helping financial institutions stay compliant. The Colorado Division of Banking and Department of Regulatory Agencies set strict standards that work with federal rules while addressing local needs.

One big rule is Colorado's Data Breach Notification Law, which says businesses must quickly tell people if their personal data gets exposed. This has led many Denver cybersecurity companies to create special response plans for financial institutions.

The state's rules keep evolving to handle new threats, and there's more teamwork between regulators and cybersecurity companies. This partnership has led to better ways to monitor compliance and handle security incidents.

Best Practices for Compliance in the Financial Sector

Financial institutions in Colorado need comprehensive strategies to follow both state and federal rules. Working with established local cybersecurity companies has become essential for strong compliance programs. These partnerships help institutions keep up with changing rules while maintaining effective security.

Having good cyber liability insurance is crucial. In Colorado, this insurance typically covers various breach-related costs, including legal fees, regulatory fines, and notifying affected customers. Banks should regularly review their coverage to make sure it matches their risks.

Best practices include:

- Running risk assessments and security tests every quarter

- Using automated systems to monitor compliance

- Keeping detailed records of security measures and incidents

- Having clear steps for handling security incidents

- Updating security policies as new threats emerge

- Building dedicated teams with cybersecurity expertise

The teamwork between financial institutions and local security providers has created a strong system for following rules while protecting against evolving threats. This partnership approach works particularly well for handling Colorado's unique financial sector challenges.

Conclusion

Denver and Colorado's financial cybersecurity landscape keeps changing rapidly, requiring increasingly sophisticated protection methods. As we've seen, the stakes are incredibly high, with cybercrime costs expected to reach record levels soon.

Denver and Colorado's position as growing tech hubs brings both opportunities and challenges. Financial institutions here need to balance new technology adoption with strong security while following complex regulations. The growing local cybersecurity community provides valuable expertise for tackling these challenges.

Success in this dynamic environment requires a complete approach: strong security protocols, employee training, advanced technology, and strict regulatory compliance. Financial institutions that embrace these elements while staying flexible to new threats will be best positioned to protect their assets and keep customer trust.

Moving forward, sustainable cybersecurity depends on cooperation between financial institutions, security providers, and regulators. This partnership approach, combined with ongoing investment in security infrastructure and talent development, will help keep Colorado's financial sector strong against evolving cyber threats.

To ensure your institution is prepared for the evolving cybersecurity landscape, partner with Tekkis Cyber Security. We provide tailored solutions and expert guidance to help you enhance your security posture and protect your assets. Contact us today to learn more!